Written by

Ruban Selvanayagam is a professional cash homebuyer, private rented sector landlord, auction specialist, blogger and media commentator.

Edited by James DurrJames Durr

Edited by

James Durr is a passionate property entrepreneur with a strong foundation and background in business.

A Memorandum of Sale is a written confirmation of the essential details of a property transaction.

It’s a simple document that’s drawn up by the estate agent after a property goes from being Under Offer to Sold STC. Auctioneers and home buying companies also often have tailor-made versions.

It is then forwarded to the solicitors representing the buyer and the seller. Email is the most common way of doing this. Although sometimes it’s posted.

Most Memorandums of Sale contain the following (in order of priority):

Essentially, the more information the better.

The Memorandum of Sale should be drafted as quickly as possible in order to get the sale going.

Below is an example of the Memorandum of Sale we use here at Property Solvers (for both our fast house sale, auctions and 28-day estate agency services):

In most cases, no. This is because the document contains confidential information about the seller and the buyer that’s data protected.

Please don’t worry about this. Your solicitor will reveal any important issues (and help you deal with them).

This is why we recommend working with a firm that will keep you fully informed.

Having a Memorandum of Sale enables all the key information to be in one place.

A huge amount of unnecessary time is saved in the ‘to-ing and fro-ing’ that comes with selling a house.

Once the sale has been confirmed, the agent should get the document circulated as quickly as possible. This means the sale can proceed quickly and efficiently. We also recommend producing a Memo (using the template above) even if you’re selling privately.

It’s not a complete confirmation, nor is it legally binding.

Whilst the buyer can still withdraw from the sale, as long as things are kept honest and transparent from the start, this shouldn’t happen.

Note that you do not need to sign the Memo of Sale.

When you sell your house to a quick buying company, the process is slightly different.

The sales process is much faster and you should be given a firm date for exchange / completion.

For example, here at Property Solvers, we have previously exchanged contracts in 24 hours (in repossession cases, for example).

There may be specific stipulations in the document such as the provision of a cash advance.

These scenarios require our solicitors to have key information up front. We’ll also take out insurances to make sure the sale is guaranteed.

The added bonus is that our clients will not need to seek out conveyancing quotes nor worry about estate agency costs – as we cover all associated fees.

The Memorandum of Sale at an auction also differs.

At an auction sale, once the hammer (or gavel) falls, the buyer effectively exchanges contracts. He/she is legally committed sale.

He/she will then be required to complete the Memorandum of Sale straight away plus pay the deposit (usually between 10 and 25%) and the auction house fees.

Note that all the ID checks are done on the day as well.

The Memorandum of Sale will then be forwarded to both solicitors alongside the exchange contract other relevant documentation.

Note that online auction houses will have a similar process. These firms are often more efficient and faster than traditional auction houses.

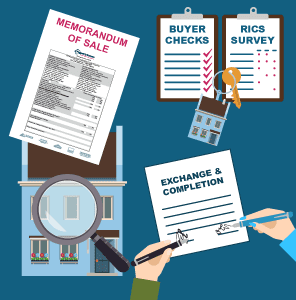

The Memorandum of Sale is the first stage of the house sale process.

It means that the estate agent, if you are using one, can change the property listing to ‘Under Offer’ or ‘Sold – Subject to Contract (STC)’

Once both solicitors receive it, the real work can then start.

But… It certainly does not mean that everything is done.

Please ensure that your estate agent has checked the buyer’s financial position before moving forward with things.

Typically, this means proof of a mortgage offer (within the last 2 months). This is sometimes known as a ‘Decision in Principle (DIP)’ or ‘Agreement in Principle (AIP)’.

We sometimes also ask for proof of deposit to make sure the buyer can truly afford the purchase.

Both solicitors begin communicating with each other to start the process.

They will also undertake the necessary ID checks (if they haven’t already) and may ask for some funds on the account to start their work.

The following forms will need to be filled out:

The solicitor will also require:

The necessary arrangements with the mortgage company can also now start.

This is to make sure the mortgage funds can be drawn down at the point of contract exchange.

The buyer’s solicitor will also undertake Local Authority, Environmental, Water/Drainage, Chancel repair, Coal/Tin mining, Brine/Common Registration and Clay searches.

Most buyers will book in some kind of survey.

The main ones – which always should be conducted by a professional from the Royal Institute of Chartered Surveyor (RICS) – are:

This is usually a minimum requirement of most mortgage companies.

The survey involves a check on the overall state of the property without going into too much detail.

It will involve a RICS-qualified surveyor spending no more than an hour (depending on the size).

The surveyor will flag up any notable issues. However, it’s not the best form of survey to use if the property has serious conditions.

This a more in-depth survey that provides key information about any potential issues with the property.

For example, the report will highlight damp, subsidence or other structural issues.

Qualified surveyors will report these problems without moving furniture or causing any real disruption to the seller.

The homebuyers survey will also have a valuation. This will typically use HM Land Registry sourced data (highlighted in this post) and factor in any issues.

It sometimes means that the buyer may approach the seller to renegotiate the price downwards.

Here, it will be at the seller’s discretion to move forward or not.

Once you agree to the price correction, there’s usually no need to revise the Memorandum of Sale.

Simply informing the solicitors should be enough.

The Level 3 Building’s Survey is the most rigorous form of survey available which buyers sometimes go for to get peace of mind.

Despite the higher cost, buyers often get one if the property is old, unrefurbished for years or it’s unusual in some way.

The surveyor will take an almost forensic approach and produce an exhaustive report running through the works required.

The buyers will also see information about the costs to bring the property back to a good standard.

In other circumstances, a Red Book Valuation may be more appropriate (or can be undertaken together with one of the above).

The solicitors will communicate between themselves and raise “enquiries” (typically via email) that could potentially affect the sale. Examples include checks for encumbrances, restrictive covenants, positive / negative easements, overage clauses amongst others.

Other times, if the property is leasehold, checks will need to be made with the freeholder / management company.

Once they have all this, they’ll summarise their findings. Your solicitor may refer to this as the Report on Title.

Assuming the survey comes back fine and there are no further enquiries, the solicitors will agree on a date for exchange and completion.

You will be sent a Transfer (TR1) form to sign and send back. Note you’ll need to independently witness this form.

These can often happen on the same day, over a couple of days/weeks or even months. In most cases, most buyers and sellers prefer to exchange and complete quickly.

A property sale chain is when a home buyer and seller end up tied together as the purchase is dependent on another transaction.

The ideal buyer usually isn’t selling his/her own property to buy yours.

This means that the risks of the other sale falling through will not pass on to you.

There are ways to get through a situation where a dependent sale does fall through.

In our experience, communication is key.

Experienced solicitors will know how to handle such cases and eliminate any potential problems in good time.

Remember to watch out for ‘gazundering‘. This is where homebuyers try to drop the price at the last minute and sadly happens in our own industry.

Sadly, it happens a lot in our industry.

In such scenarios, if you can, it’s always best to step away from the transaction.

For an idea of the quick house sale processes here at Property Solvers, check out our quick cash sale (how we work) and 28-day estate agency (how we work) pages.