A bailment is the act of placing property in the custody and control of another, usually by agreement in which the holder (bailee) is responsible for the safekeeping and return of the property. When a bailment is for the exclusive benefit of the bailee, the bailee owes a duty of extraordinary care. If the bailment is for the mutual benefit of the bailee and bailor, the bailee owes a duty of ordinary care.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ailment agreement for a car with a loan is a legal contract between a lender and a borrower that outlines the terms and conditions regarding the possession, use, and repayment of a vehicle secured by a loan. This agreement is crucial as it establishes the rights and responsibilities of both parties involved in the transaction. Keyword-rich terms that can be incorporated in the content include "ailment agreement," "car loan," "possession," "use," "repayment," and "secured." There are typically two main types of Ailment agreements for a car with a loan: 1. Title-Holding Ailment Agreement: Under this arrangement, the lender retains the title of the vehicle until the borrower repays the loan in full. The borrower possesses the vehicle and has the right to use it as long as they fulfill the loan obligations. This agreement provides the lender with security in case of default, as they maintain possession over the title until the loan is settled. 2. Security Agreement: This type of Ailment agreement allows the lender to hold a security interest in the vehicle. The borrower retains possession and use of the car during the loan period but provides the lender with the right to repossess the vehicle in case of default or non-payment. The security interest is usually registered with relevant authorities, ensuring the lender's legal claim on the vehicle. Both types of Ailment agreements highlight the importance of properly documenting the terms and conditions, including repayment schedules, interest rates, and any applicable fees or penalties. These contracts also address insurance requirements, maintenance responsibilities, and the consequences of breach or default. It is crucial for both parties to carefully review and understand the terms outlined in the Ailment agreement before signing. Seeking legal advice or consulting a financial professional is advisable to ensure that all legal and financial implications are understood and properly addressed. Remember, an Ailment agreement for a car with a loan is a legally binding contract that protects the interests of both the lender and the borrower. By clearly defining the rights and obligations of each party, this agreement helps facilitate a smooth, transparent, and mutually beneficial financial transaction.

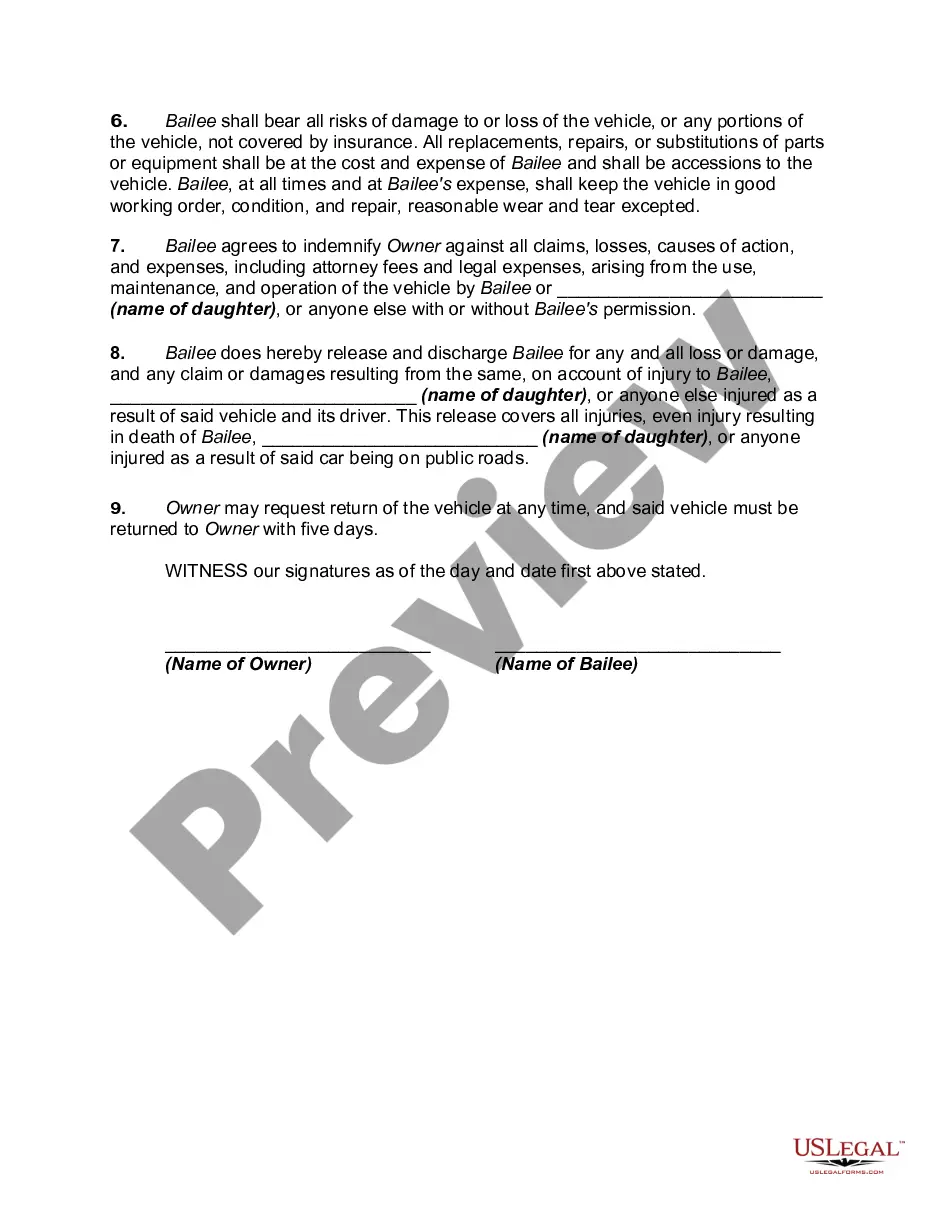

Free preview Bailment Agreement

The Bailment Agreement For A Car With A Loan you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and local laws. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Bailment Agreement For A Car With A Loan will take you only a few simple steps:

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.